When it comes to the West’s problems with Russia, there is a unique opportunity for the U.S. to fuse economics and geopolitics in partnership with Europe to significantly tip some current balances in the West’s collective favor

By Brian E. Frydenborg (LinkedIn, Facebook, Twitter @bfry1981) June 27, 2021; Also see my subsequent article “Why is Putin pulling all this crap now?“, published February 21, 2022, and excerpted from my Small Wars Journal article from the same day, “The Utter Banality of Putin’s Kabuki Campaign in Ukraine“

SILVER SPRING—As the West increasingly faces a Russia dealing out far more damage to the West than it suffers in response, the United States has a unique capacity to weaponize its oil and natural gas and oil sectors to alter the dynamics of the corresponding European markets in ways that can seriously weaken Russian power and influence in Europe, damage the Kremlin’s economic strength that has been itself weaponized against the West, and increase Western unity and economic ties.

A New Cold War

There was optimism as Putin stabilized a chaotic post-Soviet Russia, but towards the end of the first decade of the twenty-first century, that optimism quickly gave way to dread as he plunged Russia into cyberwarfare against NATO-member Estonia in 2007 and, even worse, invaded and annexed parts of Georgia in the middle of the 2008 Summer Olympics. Cyberwarfare against the West (as I chronicled recently), military adventurism, brazen political interference, bad-faith behavior, and gaslighting have been Russia’s norms ever since, from invading and annexing parts of Ukraine to helping to install Trump in the White House and from routine bombing of hospitals and other civilian infrastructure in Syria to pushing coronavirus disinformation.

The U.S. has staked much of its blood and treasure over decades to ensure military security, political stability, and economic prosperity throughout the continent. Conversely, Russian President Vladimir Putin has increasingly staked many of his efforts as the twenty-first century has unfolded to undermine all of this. Simply put, Russia usually does not treat diplomacy or international law with respect and has not shown itself amenable to changing course through good-faith engagement; rather, it continues to behave as a hostile, bad-faith actor vis-à-vis the U.S., Europe, NATO, and the West. The impunity that Russia has enjoyed under Putin is enabled by a lack of consequences and punishment for Russia’s bad behavior that itself enables further destructive behavior in a geopolitical negative feedback loop. Thus, relatively consistently weak responses from the West have succeeded not in deterring Putin, but in emboldening him.

Clearly, a much tougher approach is warranted, as I have argued for some time.

While imposing sanctions—in particular through Magnitsky legislation and going after Putin regime finances—derailing the nefarious Nord Stream 2 pipeline, and expanding Western military alliances and deployments are obviously crucial ways Russia can be punished and countered, good-old-fashioned economic competition can be as effective as more traditional political and military statecraft, perhaps even more so.

And on this front, America and Europe can work together to hit Russia where it is particularly vulnerable.

An Economic Geopolitical Arms Race with Europe As the Proving Ground

Perhaps most surprising among all of Putin’s achievements in recent years has been the extent to which Russia has infiltrated Europe. Using Europe’s openness against it, Putin and his allies have used a “firehose” of disinformation to affect public opinion throughout Europe to its advantage (part of why I recently proposed major reform to NATO’s founding charter when it comes to cyberwarfare and disinformation) while also finding allies among major European political figures through financial corruption, appealing to far-right nativism, or a combination of the two.

Indeed, for years Putin has funded far-right (and sometimes far-left) extremist parties and figures in his constant quest to weaken the European center and destabilize the continent, sometimes even forming formal alliances through his own thoroughly banal political party, United Russia, with other similarly inclined revanchist chauvinistic right-wing parties in Europe, including in NATO heavyweights Italy, Germany, and France.

The issue of financial and economic infiltration in Europe was an especially sensitive and worrisome one as presented by a report on Russia authored last year by the Intelligence and Security Committee (ISC) of the UK Parliament, which noted systemic infiltration of Britain’s economy and society by Russia through Russian businesses, noting “it is widely recognized” that Russian businesses are “completely intertwined” with “Russian intelligence” (in fact, as I have noted repeatedly, it is often difficult to distinguish between the Kremlin, Russia’s infamous oligarchs, and the Russian mafia, which often act together as one towards the same purposes, a Holy Trinity in Putin’s religion of realpolitik raw power). The infiltration is at such deep levels that the report (which I discussed in detail) states “this cannot be untangled and the priority now must be to mitigate,” a disheartening official admission that Russian malign influence is currently too big to be defeated outright, with the report also noting similar mechanisms of influence spreading throughout Europe.

Simply put, one of the main weapons in this overarching campaign against Europe is Russia’s economic might. Particularly weaponized by the Kremlin for geopolitical aims are Russian oil and natural gas, with taxes on the oil and gas sectors in Russia accounting for 39.25% of the Russian federal government’s revenue in 2019 (leaving the aberrant 2020 pandemic year aside) and the two industries accounting for a huge part of the oil-and-gas-dependent Russian economy.

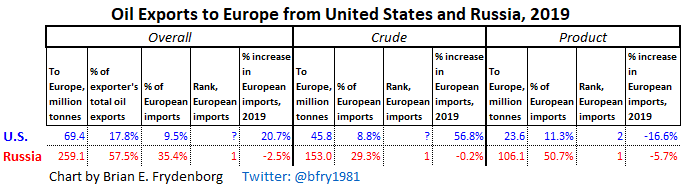

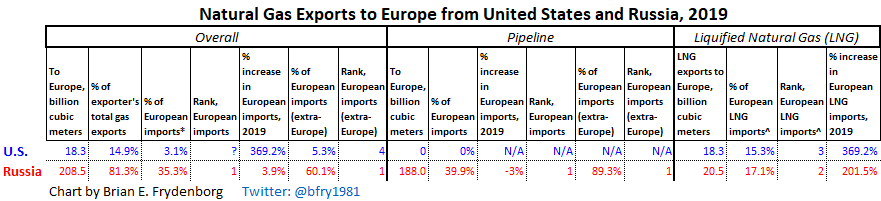

Logically, the U.S. targeting Russia’s share of those commodities’ markets in Europe can advance collective Western interests and unity while weakening and punishing Putin in ways long overdue. It would only be fitting since Russia has long used its oil and gas exports and other economic ties to Europe as a geopolitical club, bribing and bludgeoning nations and politicians throughout Europe to bend them to its will or otherwise expanding its influence. The most dramatic example of this is clearly Ukraine, which I have chronicled in detail for years. But apart from Ukraine, most of Europe is heavily dependent on Russian oil and natural gas, while Russia itself is dependent economically on its exports to Europe, as the below tables I created demonstrate along with America’s ability to push its way into Russia’s European market share (click on each chart to see the full-size version; also available all together as a single image or in one Excel file):

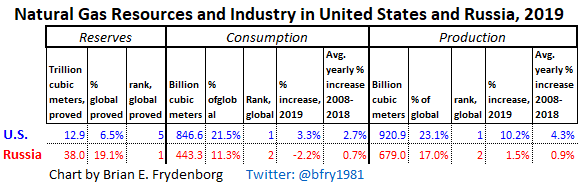

In fact, it is the U.S. that has become the world’s top oil and natural gas producer ever since the Obama Administration, and in the decade before 2019, the U.S. increased its oil production at almost six-and-a-half times the pace per year on average as Russia and increased natural gas production at almost five times the rate per year on average compared with Russia.

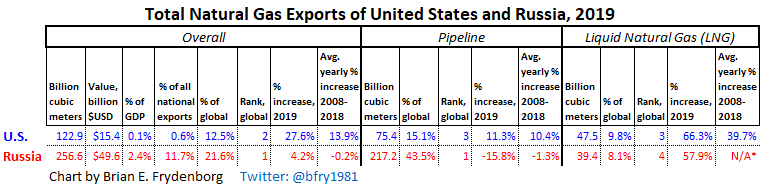

Until recently, the United States was not even a player in the European gas market, dominated by neighboring Russia. But the last decade has seen an explosion of both U.S. and Russian exports of liquified natural gas (LNG), which can be transported without pipelines, with the U.S. increasing its LNG exports by nearly 370 percent to Russia’s roughly 200 percent in 2019. U.S. entry through LNG has meant a dramatic increase in its overall gas presence in Europe in recent years while Russia’s gas exports to Europe only increased 3.9 percent in 2019, the lion’s share of that through its vast pipeline network.

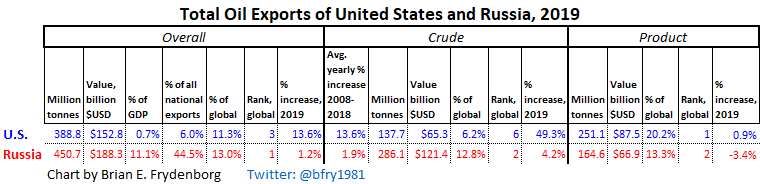

So while Russian gas exports to Europe dwarf those of the U.S. (well over 1,000 percent more), the U.S. has demonstrated far more ability to grow its European market share in recent years and will be able to keep doing so in the years soon to come, its European gas exports only amounting to about 15 percent of all its gas exports while Russia’s gas exports to Europe are over 81 percent of its total gas exports. Similar dynamics are at play when it comes it comes to oil, with the U.S. sending a bit under 18 percent of all its oil exports to Europe while Russia sends 57.5 of all its oil exports to Europe.

And though U.S. oil and gas exports are well under 7 percent of all its exports and are not even 1 percent of its GDP, for Russia, oil and gas exports account for over 56 percent of all exports and 13.5 percent of its GDP. Taken together, it is clear that oil and gas trade with Europe is huge portion of Russia’s economic trade and a significant portion of its GDP and that it would be fairly easy for the U.S. to weaken Russia’s economy profoundly by simply displacing big portions of Russia’s vital European oil and gas trade with oil and gas from the U.S., a prospect that Europe seems eager to make a reality.

While Russian exports are utterly dominated by massive state-owned companies (like Gazprom and Rosneft, among others) following Putin’s will, the U.S. has its own long tradition of subsidizing its oil and gas industries, so subsidies to make U.S. oil and gas exports to Europe more profitable and desirable would hardly be anything dramatic. Costs of taxes, tariffs, and transportation could all be mitigated through various government initiatives and, indeed, the U.S. has a number of provisions currently in place, though those subsidies may not be required since U.S. market share in Europe has been booming. Still, even as new U.S. President Joe Biden seems keen (for good reason) on eliminating such subsidies for oil and gas, giving the U.S. oil and gas sector incentives to focus much more of their business on Europe could further justice in punishing Putin and it would be a good idea here to view the economic and foreign policy goals as going hand in hand. Pursuing each without view of the other may weaken the payoff of each policy, but combining them would align with a host of Biden Administration and traditional U.S. priorities, such as promoting human rights and transparency, strengthening transatlantic relations and traditional alliances, invigorating the rules-based international order, holding bad actors accountable, promoting European unity, and furthering U.S. economic interests.

Of particular note from recent history is that the U.S. under Obama may have coordinated with Saudi Arabia to work to manipulate oil markets to drive down prices and hurt Russia economically for its dismembering of Ukraine and supporting the murderous regime of dictator Bashar al-Assad in Syria, giving potential inspiration for the U.S. to get creative and ambitious concurrently when it comes to Russia and energy geopolitics today.

A Relatively Easy, Risk-Averse Way to Strike a Blow for the West Against Russia

In concert with Europe, the U.S. has the ability to deal a well-deserved punishing blow to Putin and his rogue government by exporting significantly more oil and natural gas into Europe, weakening the Kremlin economically and reducing its growing stormcloud of influence in Europe in a manner that strengthens transatlantic relationships at the heart of the Western-led global international order and promotes the interests of the U.S. and Europe alike. While President Biden has clearly shored up the West’s diplomatic front against Russia at the recent G7 and NATO summits in Europe, the economic front discussed herein is another timely opportunity for robust, efficient, and lucrative action.

© 2021 Brian E. Frydenborg all rights reserved, permission required for republication, attributed quotations welcome

Also see my subsequent article “Why is putting pulling all this crap now?“, published February 21, 2022, and excerpted from my Small Wars Journal article from the same day, “The Utter Banality of Putin’s Kabuki Campaign in Ukraine“; see my other related article on the UK Parliament’s singularly excellent Russia report, and my discussion as a member of a panel with author and Senior International Correspondent for The Guardian, Luke Harding, on Russia’s bad behavior

Also see my eBook, A Song of Gas and Politics: How Ukraine Is at the Center of Trump-Russia, or, Ukrainegate: A “New” Phase in the Trump-Russia Saga Made from Recycled Materials, available for Amazon Kindle and Barnes & Noble Nook (preview here), and be sure to check out Brian’s new podcast!

If you appreciate Brian’s unique content, you can support him and his work by donating here

Feel free to share and repost this article on LinkedIn, Facebook, and Twitter. If you think your site or another would be a good place for this or would like to have Brian generate content for you, your site, or your organization, please do not hesitate to reach out to him!